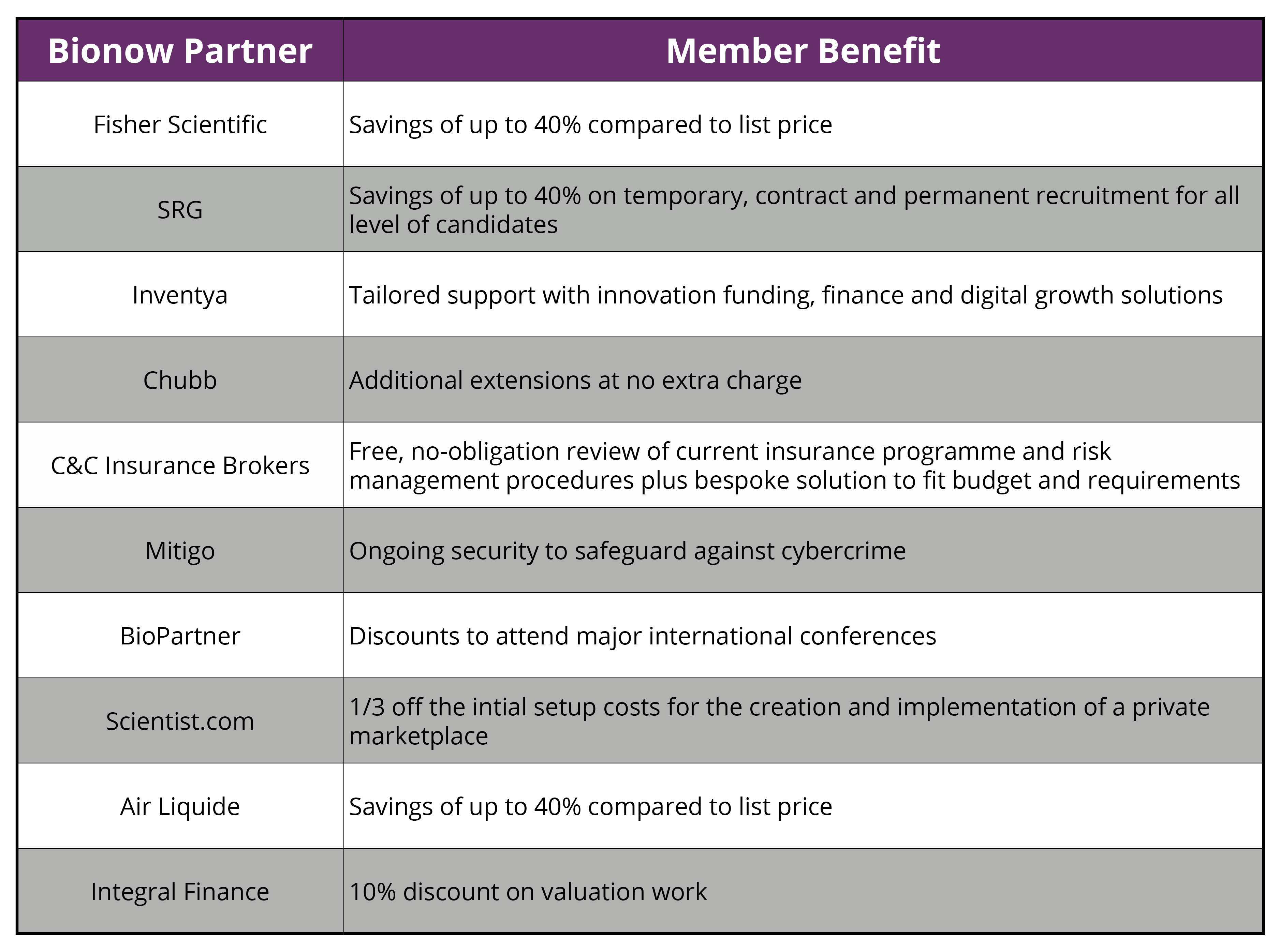

Bionow membership offers exceptional value and as a member you can bolster your bottom line by procuring goods and services with Bionow’s Preferred Partners. Focused upon the purchasing needs of member companies, this covers laboratory supplies, financial services and a suite of specialist services tailored to the needs of Bionow members. Listed in the directory are carefully selected Bionow Partners that offer added value to our members. Further details regarding each of our Partners is below.

Bionow's Preferred Partners