Cellular Agriculture – Innovating through the Challenges

The last year (2023) has seen a difficult environment for Cellular Agriculture (Cell Ag) companies working to commercialise cultivated meat.

Overall investment in Cell Ag fell 78% between 2022 and 2023 and there were numerous reports of CellAg companies running into financial difficulties. This unfavourable funding environment is likely to lead to increasing numbers of failures amongst the smaller or less innovative companies in the next year or so. However, the potential rewards for successfully addressing the challenges of commercialising cultivated meat products are huge and a number of well-financed companies will continue to actively address these challenges.

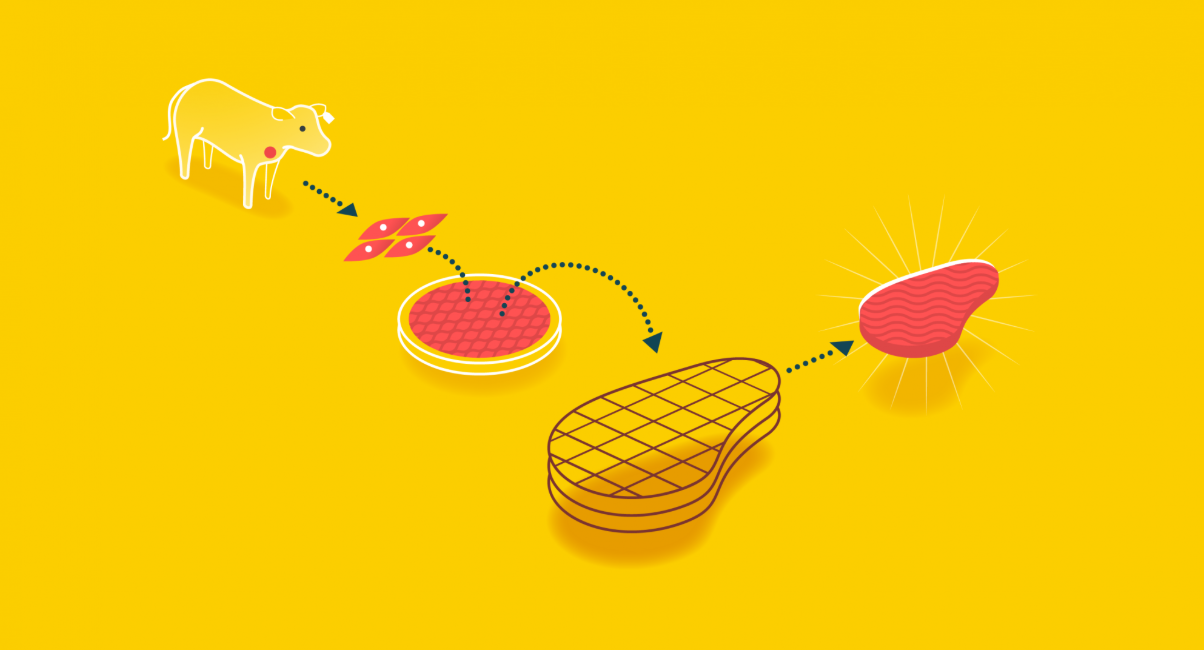

Not least amongst the obstacles to the widespread commercialisation of cultivated meat products is securing approval from regulators and persuading large numbers of customers to eat cultivated meat products. However, the main technical challenge for Cell Ag companies is the relative cost of production. Cultivated meat products are currently many times more expensive to produce than conventional meat products and production costs will need to be reduced significantly in order for cultivated meat products to compete.

Reducing the cost of producing cultivated meat to achieve parity or near-parity with conventional meat is likely to require significant levels of innovation and investment from Cell Ag companies. This innovation is likely to be reflected in an explosion of patent filings in the coming months and years as the R&D efforts of these Cell Ag companies is converted into IP assets.

The claims that we might see in these patent filings will be directed to the key factors influencing the scalability and cost-efficiency of Cell Ag production processes.

Culture processes

The processes of cell culture that are used to produce cultivated meat products are likely to be a major focus of innovation. This innovation might involve both the culture and expansion of stem cells and precursors, such as myocyte or adipocyte precursor cells, as well as the differentiation of the stem cells into mature myocytes/adipocytes (and ultimately muscle/adipose tissues).

Innovations that increase the efficiency of stem cell culture, for example by increasing the expansion of such cells from a starting cell population of given size, or within a given period of time or providing for the production of larger quantities of muscle/adipose tissue from a given starting population of progenitor cells, may be particularly valuable therefore. Innovations that reduce the time required for the terminal differentiation of myocytes or adipocytes or increase the proportion of precursor cells that terminally differentiate within a given period may also be important.

Patent filings are likely to cover all aspects of these innovations. For example, patent claims might be directed to methods of cell culture. Such claims typically recite one or more process steps in which one or more of the cells, culture medium, supplemental growth factors and/or the culture conditions are defined in accordance with their contribution to the innovation. Other claims might be directed to the cell culture medium and cell culture additives themselves.

Because large amounts are required for production at commercial scale, culture medium is one of the main drivers of costs of cultivated meat products and is likely to be a focus of attention for innovative Cell Ag companies. This is likely to lead to many innovations in the next few years that lower the cost of culture medium and increase its efficiency in converting nutrients into cellular biomass.

One particular issue is animal-derived serum and derivatives. These are ingredients of many conventional cell culture media. However, not only are they expensive, but animal-derived ingredients also raise safety concerns and impact on the ethical position that many Cell Ag companies see as key to the widespread uptake and consumption of cultivated meat products. Cell Ag companies will therefore be innovating to replace these animal-derived ingredients, and we are likely to see an increase in patent filings directed at formulations of culture media that lack animal-derived serum products or contain only minimal quantities of such products.

One promising approach is to replace animal-derived ingredients with recombinantly-produced growth factors. This may lead to patent filings directed to animal serum-replacement culture media formulations comprising cocktails of recombinantly-produced growth factors. In addition, recombinantly-produced growth factors that have engineered for increased potency and/or stability in Cell Ag processes may also be subject of patent filings. We could also see patent filings directed at small molecules that reproduce the effects of recombinant growth factors in Cell Ag processes, but which are cheaper and more stable in culture.

Species-optimised cell culture

Many of the standard techniques and materials employed for cell culture were originally developed for basic research in cell biology and regenerative medicine. These techniques and materials were therefore developed for human cells or cells from model species (e.g. rodents, non-human primates, etc.) and are likely to require adaptation for cells from livestock and other species of interest to Cell Ag companies.

We therefore expect increasing numbers of new patent filings relating to cell culture methods, cell culture medium formulations and cell culture additives for the optimised culture of cells from livestock species.

Different Cell Ag companies have focused on cultivated meat from different species, ranging from conventional meat species, such as beef and chicken, to aquatic species, such as tuna and octopus. The optimal culture conditions for cells from each species may be different. Cell Ag company will therefore need to innovate around their particular species of interest and patent filings may include claims directed to methods and compositions specifically designed or optimised for the culture of cells of a given species.

To encourage consumer adoption of cultivated meat products, Cell Ag companies will also continue to innovate around replicating the appealing properties of conventional meat. Innovation in this area may give rise to an increase in patent filings covering methods and compositions specifically designed for the culture of particular tissues, and to methods and compositions for the production of muscle or adipose tissues with particular characteristics of interest. For example, methods for producing tissue with higher myoglobin content, producing more ‘meat-like’ products. This may involve techniques and formulations for enhancing muscle fibre formation and contractility, e.g. through mechanically/electrically-stimulated contraction.

Another key area of innovation for Cell Ag companies is the initial cell stock from where cultivated meat products are produced. These cell lines need to be highly-stable and to expand and differentiate efficiently and reliably into cultivated meat. Innovations may improve the characteristics of these cell lines and may for example improve their ability to grow rapidly to high density in single cell suspension. These innovations may be reflected in patent filings with claims to methods and agents for producing multi/pluripotent progenitor cells from somatic cells obtained from livestock species, methods and agents for immortalising myocyte/adipocyte precursor cells, and also claims to the cells and cell lines themselves.

Bioreactors, substrates and scaffolds

Production at commercial scale is a key challenge for Cell Ag companies. To meet this challenge, the equipment and techniques employed for the large-scale culture of cells from different species and tissues will need to be subjected to further innovation. We anticipate patent filings relating to new bioreactors providing for high scalability, e.g. by providing sufficient agitation to minimise nutrient, pH, dissolved O2 and waste gradients while minimising sheer stress on the cells in culture, and/or by allowing continuous culture. We may also see an increase in patent filings relating to new cell culture substrates, such as e.g. microcarriers having novel chemical composition and/or structure for the optimal culture of myocytes/adipocytes and precursors.

As the industry moves towards the production of cultivated meat products more closely resembling animal tissue, we expect to see an increase in patent filings directed to methods and articles (e.g. scaffolds) for the co-culture and differentiation of cells of different kinds for the production of complex tissues with defined structure, e.g. comprising muscle, adipose and connective tissue. For example, methods may employ 3D printing to reconstitute naturally-occurring tissue architecture, possibly with the aid of appropriate scaffold materials. We could also see an increase in patent filings directed to novel, degradable or safe and palatable scaffolds, which may be used to form networks for perfusion of nutrients, O2 and for waste removal during production of tissues with a thickness greater than diffusion limits.

The challenges of commercialising cultivated meat products are considerable. Despite the unfavourable funding environment of the last 12 months, there are still numerous well-financed companies actively tackling these challenges. The innovative solutions required are likely to lead to ever increasing numbers of patent filings in the next few years as Cell Ag companies look to attract inward investment and maintain their competitive position as the widespread adoption of cultivated meat products comes closer to reality.